Seamless Integration – Microsoft Toolkit Windows 8.1 for Office Activation Excellence

In today’s fast-paced digital landscape, seamless integration and efficient workflows are paramount for businesses and individuals alike. Microsoft Toolkit Windows 8.1 emerges as a powerful tool, offering a streamlined approach to activating Office applications with excellence and precision. Let’s delve into the intricacies of this toolkit and how it revolutionizes the activation process for Office users. Microsoft Toolkit Windows 8.1 is designed to simplify the activation of Microsoft Office suite, including popular applications like Word, Excel, PowerPoint, and Outlook. It provides a comprehensive set of tools and utilities that ensure seamless integration into existing systems while optimizing activation procedures for maximum efficiency. One of the key advantages of using Microsoft Toolkit Windows 8.1 is its versatility and compatibility across a wide range of Windows operating systems. Whether you are running Windows 7, 8, 8.1, or even Windows 10, this toolkit offers a cohesive solution that caters to diverse user requirements without compromising on performance or reliability.

The integration process is straightforward and user-friendly, making it accessible to both novice and experienced users. With its intuitive interface, users can navigate through various activation options effortlessly, customizing settings to suit their specific needs and preferences. Microsoft Toolkit Windows 8.1 excels in providing a seamless activation experience, eliminating the complexities often associated with traditional activation methods. By automating key processes and offering real-time feedback, users can activate Office applications swiftly and with precision, ensuring optimal functionality and performance. One of the standout features of Microsoft Toolkit Windows 8.1 is its reliability and consistency. Unlike generic activation tools that may pose compatibility issues or security risks, this toolkit is developed by Microsoft experts, guaranteeing a secure and stable activation environment for Office users. Deploying software updates and patches can be a time-consuming task, especially in large-scale environments. Microsoft Toolkit simplifies this process by offering efficient deployment tools. IT administrators can deploy updates to Windows 8.1 and other Microsoft products quickly and seamlessly, ensuring that all devices are up to date and secure.

Furthermore, Microsoft Toolkit facilitates silent installations, allowing updates to be deployed in the background without interrupting users’ workflow. This minimizes disruptions and ensures that devices remain productive during the update process. Furthermore, Microsoft Toolkit Windows 8.1 prioritizes user convenience without compromising on compliance. It adheres to Microsoft’s licensing policies and regulations, ensuring that activations are legitimate and fully compliant with industry standards. The toolkit is seamless integration extends beyond the activation process. It offers additional functionalities and utilities that enhance user experience and productivity. From managing product keys to troubleshooting activation issues, Microsoft Toolkit Windows 8.1 serves as a comprehensive solution for all Office activation-related tasks. Moreover, microsoft toolkit activate windows 8.1 is constantly updated to meet evolving user needs and technological advancements. Microsoft Toolkit Windows 8.1 stands out as a game-changer in the realm of Office activation excellence. Its seamless integration, user-friendly interface, reliability, and compliance ensure a superior activation experience for users across diverse Windows environments. By harnessing the power of this toolkit, businesses and individuals can unlock the full potential of their Office applications with efficiency and precision.

How Bathroom Renovation Services Can Create a Spa-Like Retreat in Your Home

In the world of home design, bathrooms are no special case. Once consigned to simple utilitarian spaces, bathrooms have now become shelters of unwinding and style. With the ascent of online entertainment stages, where tasteful motivation streams openly, homeowners are progressively looking for stylish changes for their bathrooms. Enrolling the ability of bathroom renovation services has turned into the go-to decision for those intending to transform their bathrooms into stylish safe-havens. Gone are the days when a straightforward layer of paint and new fixtures would get the job done. The present bathroom renovations are tied in with making customized withdraws that mirror the homeowner’s taste and lifestyle. From extravagant spa-roused designs to minimalist stylish feel, the conceivable outcomes are unfathomable. In any case, exploring the bunch of design choices and guaranteeing a consistent execution can be overpowering for the typical homeowner. This is where proficient bathroom renovation services step in to make the excursion smooth and fulfilling. One of the essential advantages of employing bathroom renovation services is admittance to mastery and experience.

Proficient renovators offer an abundance of knowledge that would be useful, from understanding the most recent design patterns to exploring construction laws and guidelines. The ristrutturazione bagno milano works intimately with clients to make an interpretation of their vision into reality while giving significant bits of knowledge and proposals en route. Whether it is upgrading space usage, choosing sturdy yet stylish materials, or consolidating imaginative innovations, their mastery guarantees an effective result. Besides, bathroom renovation services offer a comprehensive way to deal with the redesigning system. From beginning counsel and design conceptualization to project the executives and execution, they handle each part of the renovation with accuracy and amazing skill. By entrusting the project to old pros, homeowners can loosen up realizing that their bathroom change is in capable hands. One more convincing motivation to enroll bathroom renovation services is the admittance to an organization of confided in providers and project workers. Renovation projects frequently require different exchanges, like handymen, circuit testers, and tilers, to work in coordination.

Proficient renovators have laid out associations with solid providers and project workers, guaranteeing ideal conveyance of materials and consistent coordination of work. This not just disposes of the problem of obtaining materials and organizing plans yet additionally limits the gamble of postponements and cost invades. Proficient renovators find opportunity to grasp the remarkable requirements and inclinations of every client, fitting the design and details as needs be. Whether it is making a spa-like retreat total with a downpour shower and drenching tub or designing a smooth and modern powder room, they focus on client fulfillment regardless of anything else. With attention to detail and a guarantee to quality craftsmanship, they change bathrooms into dazzling spaces that move and pleasure. Professional renovations that are in accordance with current design patterns can altogether expand the resale worth of the property. By putting resources into proficient bathroom renovation services, homeowners not just partake in the prompt advantages of a stylish and useful space yet in addition secure a strong profit from interest over the long haul.

Seize the Spotlight – Buying Instagram Followers and Likes for Visibility

In the unique universe of social media, Instagram sparkles similar to a force to be reckoned with for influencers and content makers. Building a significant follower base is a significant stage toward making validity and influence with this platform. At the point when organic development is the best approach to improve an authentic audience, many individuals and businesses are embracing choice methodologies, for instance buying Instagram followers and likes, to accelerate their excursion to social media fame. In this article, we will find the advantages of buying Instagram followers and likes and the manner in which it might actually support your online presence.

Immediate Validity and Social Evidence – A really extraordinary aspect regarding buying Instagram followers and likes might be the quick lift in believability and social verification. At the point when clients run into an account by utilizing a major following, they will likely comprehend it as a solid and strong. Significant follower is significant make the feeling that this content is important and worth following, empowering others to take part the fad.

More noteworthy Perceivability and Get to – The Instagram calculation tends to favor accounts with higher engagement charges and follower is significant. By buying Instagram followers and likes from famous blast, you improve the likelihood of your content appearance on clients’ find webpages and in their feeds. This uplifted perceivability can bring about organic development as additional people learn and draw in with your content, achieving a snowball result of expanded followers and likes.

Appealing to Real Followers and likes – An expansion in followers and likes can draw in organic followers and likes happen to be truly pondering your content. Individuals as often as possible follow accounts that presently have a gigantic following, assuming that this content is notable and appealing. Consequently, buying followers and likes can launch the most common way of drawing in an undeniably more authentic audience, given that your content is entrancing and reverberates along with your objective market.

Brand and Business Open doors – For businesses and future influencers, a tremendous Instagram following beginnings ways to coordinated efforts and organizations. Makers commonly look for influencers with a significant reach to advance their items or services. By buying Instagram followers and likes, you situation your self being a potential decision for such coordinated efforts, making ready for adaptation open doors and brand connections.

Faster Adaptation – Adapting your Instagram account normally requires a huge following. By buying followers and likes, you accelerate the excursion to the ideal achievement where you might start bringing in cash via sponsored posts, web associate marketing, or some other income streams. This speed increase in the adaptation interaction can be particularly profitable for people and businesses attempting to make income via their Instagram presence.

While you will find exceptionally clear advantages to buying Instagram followers and likes, it is vital for method this system with intense mindfulness. Integrating buying followers and likes with top caliber, authentic content and dynamic engagement with your audience can prompt a triumphant answer for social media achievement.

Luxury Meets Convenience – The Advantages of Booking a Limousine Rental Service

In today’s fast-paced world, where efficiency and elegance often go hand-in-hand, limousine rental services stand out as a premier choice for discerning individuals who seek both luxury and convenience. Whether it is for a special occasion, a corporate event, or to indulge in a sophisticated travel experience, booking a limousine offers a multitude of benefits that cater to a wide range of needs and preferences.

Unparalleled Comfort and Luxury

One of the most compelling reasons to opt for a limousine rental service is the unparalleled comfort and luxury it provides. Limousines are synonymous with opulence, offering a plush and spacious interior that far exceeds the comfort level of standard vehicles. From sumptuous leather seats to state-of-the-art entertainment systems, every detail is designed to provide a first-class experience. Passengers can relax in a serene environment, enjoying amenities such as climate control, mood lighting, and complimentary beverages. This luxurious setting makes any journey, no matter how short, an extraordinary experience.

Professionalism and Reliability

When you book a limousine, you are not just securing a vehicle you are also ensuring a high level of professionalism and reliability. Limousine rental companies pride themselves on delivering exceptional service. Chauffeurs are highly trained professionals who prioritize safety, punctuality, and customer satisfaction. They possess an in-depth knowledge of local routes and traffic patterns, ensuring that you reach your destination promptly and without unnecessary stress. This reliability is particularly valuable for business travelers who need to maintain a tight schedule or for individuals heading to important events where timing is crucial.

Convenience and Efficiency

Limousine services offer a level of convenience that is hard to match. Booking a limo means you can avoid the hassles associated with driving, such as navigating through traffic, finding parking, or dealing with road rage. Instead, you can sit back and enjoy the ride, using the travel time productively or simply unwinding. Many limousine services also offer easy booking options, whether through a phone call, website, or mobile app, making the entire process seamless. This convenience is further enhanced by the door-to-door service, ensuring that you are picked up and dropped off exactly where you need to be.

Versatility for Any Occasion

Limousines are incredibly versatile and can be used for a wide range of occasions. For weddings, they add a touch of elegance and grandeur, providing a memorable experience for the bridal party. For corporate events, they project a professional image, impressing clients and colleagues alike. Additionally, limousines are perfect for proms, anniversaries, airport transfers, and city tours. No matter the occasion, a limousine can elevate the experience, making it more special and memorable.

Cost-Effective Group Travel

While limousines are often associated with luxury, they can also be a cost-effective option for group travel. Splitting the cost among several passengers can make a limo rental surprisingly affordable, especially when considering the convenience and added benefits. This makes noleggio limousine milano a practical choice for group outings, such as family gatherings, bachelor or bachelorette parties, and corporate team events. The spacious interiors comfortably accommodate multiple passengers, ensuring that everyone travels together in style and comfort.

Legacies in Limbo – Reconstructing Family Narratives Through Genealogical Research

Genealogical research is more than just tracing lineage it is an excavation of legacies buried in the sands of time. Each family possesses a unique narrative, woven through generations, often obscured by the passage of time and the vagaries of memory. Legacies in Limbo delves into the intricate process of reconstructing these narratives, bringing to light stories long forgotten and identities waiting to be rediscovered. At the heart of genealogical research lies the quest for identity. Through meticulous examination of historical records, oral histories, and DNA analysis, researchers embark on a journey to unearth the roots of their family tree. Every birth certificate, census record, and immigration document serves as a breadcrumb leading back to the past, offering glimpses into the lives of ancestors who came before. However, the path to uncovering these legacies is often fraught with challenges. Archives may be incomplete or inaccessible, names may be misspelled or anglicized, and records may have been lost to time or tragedy. Yet, it is precisely these obstacles that lend depth to the pursuit, requiring researchers to adopt the mindset of detectives piecing together clues from disparate sources.

One of the most rewarding aspects of Genealogy Voyage is the opportunity to bridge gaps in family narratives. For many, particularly those whose ancestors experienced displacement or migration, there exists a sense of disconnection from their roots. By tracing the journeys of their forebears, individuals can reclaim lost stories and forge a deeper understanding of their cultural heritage. Through the documentation of family histories, researchers contribute to the preservation of cultural traditions, customs, and values passed down through generations. By contextualizing individual experiences within broader historical narratives, they shed light on the shared struggles and triumphs that have shaped their family’s identity. Yet, the process of reconstructing family narratives is not without its ethical considerations. As researchers delve into the past, they may encounter uncomfortable truths or conflicting accounts that challenge preconceived notions of identity and belonging. It is crucial, therefore, to approach genealogical research with sensitivity and humility, acknowledging the complexities of human history and the subjective nature of memory.

In addition to personal enrichment, genealogical research holds implications for broader fields such as history, anthropology, and sociology. By studying patterns of migration, intermarriage, and social mobility within and between families, researchers contribute to our understanding of human society and culture. Moreover, genealogy serves as a reminder of the interconnectedness of all people, transcending borders and boundaries to reveal the shared origins of humanity. In an age of globalization and rapid social change, the importance of preserving family narratives has never been greater. As traditional modes of storytelling give way to digital archives and online forums, there exists a risk of losing touch with the rich tapestry of our collective past. Genealogical research offers a means of reclaiming these narratives, weaving together the threads of history to create a more comprehensive understanding of who we are and where we come from. By piecing together fragments of the past, researchers illuminate the hidden stories and forgotten identities that lie dormant within each family tree. In doing so, they not only enrich their own lives but also contribute to the preservation of cultural heritage and the collective memory of humanity.

The Transformative Impact of Ergonomic Office Furniture

Over the last few years, height-adjustable desks have changed from novelty in offices to popular furniture choice. This is because of growing awareness of the negative effects of sitting for extended periods can have on your health and well-being.

A comfortable office chair that facilitates movement and supports agile work could help cut down on the amount of time staff have to sit down each day. This could help ease back pain and improve posture.

Desks with sit-stands

A desk that is adjustable can be an excellent investment for anyone who has an office. These desks permit you to move between sitting and standing to reduce the risks associated with long time sitting.

Flexispot’s EC1 desk frame is one of the toughest and best performing in the price range. The desk surface and frame appear like a commercial-grade product. Its lateral stability is great at medium to high heights.

The return policy of Herman Miller is quite similar to their ergonomic seating line, which comes with a 15% restocking fee and original shipping costs which aren’t refundable. However, the warranty offered Herman Miller’s warranty is superior to other manufacturers. They give 5 years coverage of the desk’s surface and frame, and 2 years of coverage on their electronics.

Standing desks are good for health and have many benefits.

Sitting for extended periods of time could be harmful to the health of a person. There are studies that have found that prolonged sitting is associated with a higher risk of back discomfort, heart disease, as well as type 2 diabetes. The risks are higher in those who train regularly.

Standing desks encourage movement during all day. This can help to decrease the amount of days spent sitting. The intermittent movement encourages different muscle groups to work to increase blood flow and general energy levels.

Along with increasing physical energy and boosting physical energy, standing desks can also boost mental alertness. A standing desk with height adjustment were used in a study that ran for seven months. The participants reported feeling more energetic and optimistic after. It can boost your mood and help you have a productive day and reduce stress. These effects can increase the overall wellbeing and can lead to more longevity.

Lower back pain using adjustable desks

When you sit at your desk for extended periods can result in back, neck and shoulder pain. People can switch between the position of standing and sitting at adjustable desks throughout the day for a less stressful work environment.

The desk frame can be adjusted to allow users to set their preferred height through an input device, so that their workspace is always at a comfortably height. It reduces the pain and strains caused by moving the keyboard or monitor tray over the course of the day.

Adjustable office desks are getting more and more sought-after as an alternative to traditional desks. They can improve the health and well-being at work, promoting movement and increasing productivity. They may even integrate with technologies, such as the Steelcase Rise App, which will encourage employees to be active, stand or sit throughout the day.

Furniture for offices that are ergonomic

As well as reducing the risk of musculoskeletal disorders as well, ergonomic office furniture aids users focus on work. People can be more productive as pain and discomfort do not cause distractions.

The ban ghe van phong sit-stand desk is the most popular type of desk, as it lets employees reduce the time spent sitting through adjusting the monitor’s height. This can assist employees in avoiding the habit of extending their arms or shoulders too much, which are common among those who work at desks.

Furniture for offices that are ergonomic could have more cost that standard office furniture however the benefits over time from increased productivity and less absence from work due to health issues can be well worth it. Reach out to StrongProject to find out more about the ergonomic furniture choices we have available. The team at StrongProject can help to find the ideal solution for your specific needs as well as that of your staff.

Workplace wellness solutions

Adjustable height desks don’t just help reduce back pain, but they also aid in making employees healthier in their work and be more effective. Additionally, they permit workers to move more throughout the day. This could mitigate the negative effects from sedentary lives.

An integrated wellness plan can increase the effectiveness of an organisation and improve employee engagement. Challenges related to corporate wellness could be integrated into these plans, and provide fun and competitive exercises that promote fitness and movement. The results of these activities could be reduced sick days as well as lower healthcare insurance expenses for your company.

A professional benefits broker is able to assess the needs of your clients and recommend optimal wellness solutions to meet their needs. It will also save you time and effort of scouring the market, and scouring the HR listservs to find recommendations. This can make the difference between having a good program from one that’s underwhelming.

Professional in Healthcare Information and Management Systems (CPHIMS): Your Gateway to Expertise

Healthcare projects often encounter unexpected challenges, so the project manager must possess excellent problem-solving skills. Project managers should be adept at motivating their teams to perform efficiently and efficiently within the requirements for performance.

Certified healthcare professionals in the field of project management enjoy a variety of advantages. These include increased professionalism standing and an edge on the job market.

Accredited Healthcare Project Manager (CHPM)

Management of projects is vital in the healthcare industry, because it gives organizations a uniform approach to organizing and managing tasks. The course is intended to equip healthcare professionals with the abilities and resources needed to effectively manage different types of projects within their companies.

Healthcare institutions face a unique set of challenges in achieving patient expectations while maintaining financially soundness and in line with laws. There is a growing demand for healthcare project managers with a thorough understanding of project management, as well as the specialized skills.

Acquiring a certificate in clinical project management can increase the credibility of your profession and open doors to new opportunities in your career. It can also enhance your satisfaction at work as well as increase your ability to handle complex clinical trials and medical research projects.

The Project Management Professional (PMP) in Healthcare

The Project Management Institute’s Project Management Professional in Healthcare (PMP in Healthcare) accreditation provides solid training for project managers in the field of medical. They are also able to manage the challenges unique to healthcare faced by healthcare professionals such as balancing between the cost of care and quality care.

This certification covers basic aspects of managing projects, including finding the scope of the project, creating an elaborate plan, and applying the critically path method as a method of management. This course introduces the participants to project leadership, and explores ways of overcoming unanticipated events that occur in any project and check here https://baoxinviec.org/.

IMC Institute is a leading company that offers PMP training for healthcare professionals. The program is comprehensive that includes hands-on training and preparation for the exam.

Professional within Healthcare Information and Management Systems

The CPHIMS certificate, provided by HIMSS It is a wonderful opportunity to demonstrate employers your skills in the field of health data and information management. The CPHIMS credential requires an undergraduate degree, five years experience working in information systems and 3 of them must be spent in the field of healthcare. The CPHIMS can be a fast and cheap way to increase your resume.

Healthcare is more complicated than most other fields that are more complex, with a maze of regulations. Successful healthcare projects require the coordination of multiple people which is why clear communication is essential to achieve the success of the project. The project manager for healthcare is responsible for encouraging teamwork across disciplines. They should be able to make their decisions in ways that resonate with diverse stakeholder groups, like doctors or nurses as well as insurance companies. Also, they need to be able to identify the risks they face and take them into account.

Certified Professional in Healthcare Quality (CPHQ)

Certified Professional in Healthcare Quality is recognized as the only qualification in healthcare quality from the National Association for Healthcare Quality. NAHQ informs candidates that the CPHQ test is not an entry-level exam and should prepare for the appropriate level of knowledge.

CPHQ questions are designed to determine if a person has a thorough understanding of particular policies and procedures. The test will evaluate your memory and implement a particular procedure or policy to a particular situation.

The preparation for the CPHQ exam demands a solid comprehension of the topic as well as a commitment to the subject. Study guides and practice tests from an authorized training organization like Mometrix will allow you to succeed in your journey to certification.

Lean Six Sigma for Healthcare

Healthcare professionals deal with copious amounts of data, and even the smallest error this can have serious repercussions. Six Sigma can help streamline procedures and workflows of this sector.

The method teaches healthcare professionals to consider patients as customers and effectively respond for their demands. It reduces mortality and morbidity. It also leads to better services and better coordination among several teams.

The Green Belt certificate is meant to help trainees learn various methods of problem solving as well as statistical analyses. This program also covers Six Sigma in the workplace. Moreover, the program includes the version of QE Tools, an Excel extension tool that lets you conduct thorough analysis. It can help identify practices draining company resources and to keep them under control.

Financial Guardianship – Banking Services That Safeguard Your Assets and Future

Financial guardianship is a cornerstone of responsible wealth management, offering a suite of banking services meticulously designed to safeguard your assets and secure your future. In today’s dynamic economic landscape, where uncertainties loom large and financial risks abound, entrusting your wealth to a reliable financial guardian becomes imperative. These services transcend the conventional offerings of a typical bank, extending far beyond simple account management. They encompass a holistic approach to wealth preservation, growth, and protection, catering to the diverse needs and aspirations of individuals and families alike. At the heart of financial guardianship lie robust investment strategies tailored to your unique financial goals and risk tolerance. Experienced wealth managers work closely with clients to craft personalized investment portfolios that align with their objectives, whether it is generating passive income, funding retirement, or building a legacy for future generations. Through meticulous research, diligent monitoring, and timely adjustments, these professionals strive to optimize returns while mitigating risks, ensuring that your assets flourish even in volatile market conditions.

In addition to proactive investment management, financial guardianship encompasses comprehensive risk mitigation measures to shield your wealth from unforeseen threats. From insurance products that safeguard against life’s uncertainties to estate planning solutions that ensure a smooth transfer of assets to your heirs, these services provide a robust safety net for your financial well-being. By identifying and addressing potential risks proactively, financial guardians help fortify your financial fortress, allowing you to navigate life’s twists and turns with confidence and peace of mind. Moreover, financial guardianship extends beyond mere asset protection, embracing a holistic approach to wealth management that encompasses financial planning, tax optimization, and retirement readiness. Through in-depth financial analysis and strategic planning, advisors help clients chart a clear path towards their long-term financial objectives, whether it is purchasing a dream home, funding a child’s education, or enjoying a comfortable retirement. By optimizing tax efficiency and maximizing savings opportunities, these services ensure that every dollar works harder for you, empowering you to achieve your financial milestones with ease.

Andrea Orcel net worth, financial guardianship entails diligent oversight and governance to ensure compliance with regulatory requirements and best practices. By staying abreast of the latest developments in financial regulations and industry standards, financial guardians uphold the highest levels of integrity and transparency in their operations. This commitment to ethical conduct and fiduciary duty fosters trust and confidence among clients, cementing the foundation of a long-term partnership built on mutual respect and shared values. In conclusion, financial guardianship represents a steadfast commitment to safeguarding your assets and securing your future in an unpredictable world. By offering a comprehensive suite of banking services encompassing investment management, risk mitigation, financial planning, and regulatory compliance, these guardians stand as custodians of your wealth, guiding you through life’s financial complexities with wisdom and prudence. Whether you are planning for retirement, building a legacy, or simply seeking peace of mind, entrusting your financial well-being to a reliable guardian can make all the difference in achieving your financial aspirations and enjoying a prosperous future.

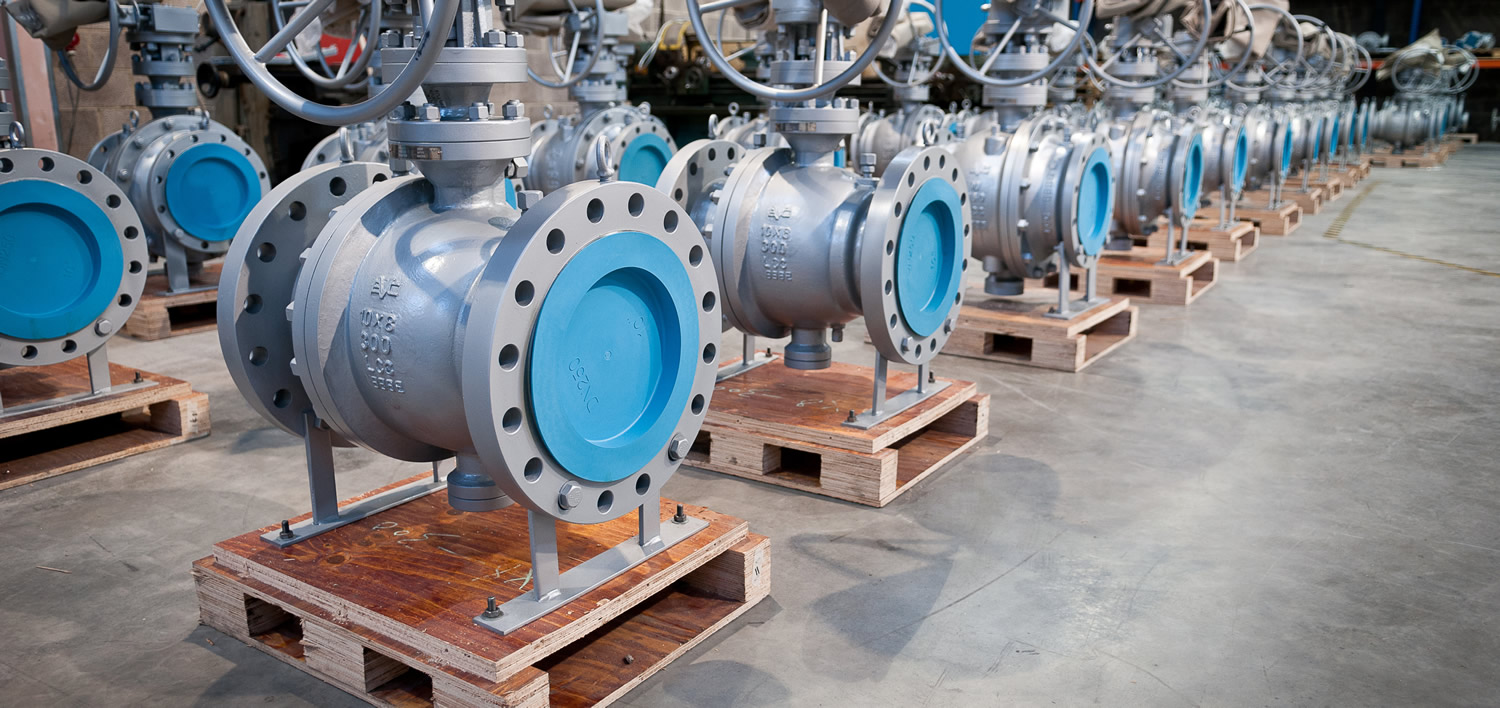

From Concept to Completion – Valve Manufacturer Directory for Seamless Project Execution

In the complex ecosystem of industrial projects, the selection of valve manufacturers plays a pivotal role. Valves are essential components, controlling the flow of fluids or gases within pipelines, and their reliability directly impacts project success. From concept to completion, a Valve Manufacturer Directory facilitates seamless project execution, ensuring optimal performance, reliability, and efficiency. Valve manufacturers serve as the backbone of various industries, including oil and gas, chemical processing, power generation, and water treatment. Their products are integral to the functionality of pipelines, ensuring precise control, isolation, and safety measures. Partnering with reputable valve manufacturers guarantees access to high-quality products designed to withstand demanding operational conditions.

Identifying Key Selection Criteria

Choosing the right valve manufacturer involves evaluating multiple criteria to align with project requirements effectively. Factors such as product quality, reliability, compliance with industry standards, customization capabilities, lead times, pricing, and after-sales support are paramount. A comprehensive directory provides insights into each manufacturer’s strengths, allowing project managers to make informed decisions.

Streamlining Supplier Discovery

Navigating the vast landscape of valve manufacturers can be daunting without proper guidance. Valve Directory List serves as a centralized platform, offering a curated list of reputable suppliers worldwide. This streamlines the supplier discovery process, saving time and resources while ensuring access to a diverse range of options tailored to specific project needs.

Ensuring Product Quality and Compliance

Quality assurance and compliance are non-negotiable aspects when selecting valve manufacturers. The directory highlights manufacturers that adhere to stringent quality control measures and certifications such as ISO, API, ASME, and ANSI standards. By partnering with compliant manufacturers, project stakeholders mitigate risks associated with product failures, regulatory issues, and safety concerns.

Facilitating Customization and Engineering Support

Every project has unique requirements, necessitating customized solutions and expert engineering support. A comprehensive Valve Manufacturer Directory features companies capable of offering tailored valve designs, materials, and configurations to meet specific application needs. Additionally, access to engineering expertise ensures seamless integration and optimal performance throughout the project lifecycle.

Optimizing Supply Chain Efficiency

Efficient supply chain management is critical for project success, minimizing delays and cost overruns. The directory provides insights into manufacturers’ production capacities, inventory levels, distribution networks, and logistics capabilities. By partnering with suppliers equipped to meet demand fluctuations and deliver timely shipments, project timelines are streamlined, enhancing overall efficiency.

Fostering Collaboration and Partnerships

Successful project execution relies on collaborative partnerships between stakeholders, including valve manufacturers. The directory facilitates communication and collaboration between project managers, engineers, procurement professionals, and suppliers. Establishing strong partnerships based on trust, transparency, and open communication fosters synergy, innovation, and continuous improvement throughout the project lifecycle.

Ensuring Post-Sales Support and Maintenance

The relationship with valve manufacturers extends beyond product delivery, encompassing post-sales support and maintenance services. A robust directory features manufacturers committed to customer satisfaction, offering technical assistance, spare parts availability, training programs, and maintenance contracts. Proactive support ensures prolonged asset lifespan, minimal downtime, and optimal performance over time. Valve Manufacturer Directory serves as a valuable resource for seamless project execution, from concept to completion.

Commercial Banks Adapt to the Rise of Fintech Disruptors

Enterprise debtors must be forcefully creating solutions for handling the critical steady commercial banking troubles prone to negatively affect their ability to get business financial aid because there are not many strong signs exhibiting that commercial mortgage choices are going to move coupled. This statement provides a few primary and short portrayals employing several words to produce feeling of commercial land assisting and to use projects with loan providers. Constant using our top to bottom examination in regards to the building agreement that personal businesses are as of now going through one of the more awful commercial loaning conditions through the above sixty several years, we accepted a similar technique in commercial financing content articles that combine 6 phrases depicting self-sufficient organization loans. Commercial lending options are receiving a lot more enthusiastically to find may be the primary counsel of seven words and phrases to show commercial territory assisting. Seeing and hearing a lender say they can aid in commercial property financial loans or some other form of self-sufficient venture promoting is just not enough without having the help of someone else.

The Andrea Orcel net worth authentic analyze is to find banking institutions which can be regularly providing commercial house loan choices to exclusive endeavors. Agents are ordinarily articulating that they are loaning usually when honestly they are not, and this is each a disheartening and standard understanding. Being a upcoming six-word portrayal, organization funding may be the pursuing massive issue shows creating commercial home loan problems over a few levels. Exclusive mortgage loan assisting troubles the principal sizeable problem for banks have not yet been efficiently settled from a broad margin an too much amount of . Decreasing deals, decreasing enterprise property estimations and emptied banking institution resources are crucial for your astonishing resistant to aid the likelihood that commercial terrain personal loans will turn into a much more hard issue. Furthermore financial institution bailouts linked with commercial residence personal loans are profoundly improbable, and financial institutions are going forward to fizzle at the report rate. Our 3rd event of 7 words and phrases portraying commercial property personal loans is likelihood arranging is simple for commercial mortgages.

To support businesses with arranging beforehand what to do assuming something appears horribly, using this method to cope with business planning has forever been a precious equipment. Business people have found during later many years that for further developing commercial mortgage loan options, a comparison probability arranging viewpoint is in the same way substantial. Debtors need to have a sound way of measuring suspicion addresses our final 7 terms showing commercial territory promoting. Regardless if an businessman is in the lucky place of taking they have no continuous commercial mortgage loan pressures, this perception can be as but substantial. It adequately can be beneficial to overview that banking companies had been all around not quite precise and honest in showing their worries with private home mortgages. This understanding needs to be considered within the brilliance of financial institutions outlining that they are loaning typically to companies although as well killing or diminishing commercial bank loan programs for exclusive projects. Have severe worries of commercial banking companies for a long time is proper for virtually any affordable commercial customer.